| S.No | Name | ROI | Tenure | Repayment frequency | Maximum borrowing limit | Required documents | Processing FEE/ EV FEE | Share Capital |

| 1 | HOME LOAN (RURAL) | 9.99% | Up to 20 Yrs | Monthly/Half yearly | 25.00 Lakhs | Applicant Request Letter, Membership Number, Aadhar, PAN, New TD, Old TD, Old Pahani, 1(B), New Pahani, Dharani EC, Sub-Registrar EC, Link Documents, CIBIL, Legal Opinion, No Dues, G-Tree ( Min 3 Generations ) along with Grama Khantam & House Permission From Panchayat Seceretary | 1% on loan amount, Max 25000+GST | No |

| 2 | HOME LOAN (URBAN) | 9.99% | Up to 20 Yrs | Monthly/Half yearly | 35.00 Lakhs | Applicant Request Letter, Membership Number, Aadhar, PAN, New TD, Old TD, Old Pahani, 1(B), New Pahani, Dharani EC, Sub-Registrar EC, Link Documents, CIBIL, Legal Opinion, No Dues, G-Tree ( Min 3 Generations ) along with House Permission From Municipal Commisioner, House Estimation | 1% on loan amount, Max 25000+GST | No |

| 3 | Loan to Rented Building Owners | 14.00% | Up to 5 Yrs | Monthly | ||||

| " for more information please visit the nearest bank branch" | ||||||||

Lets get the app and try ekit for free and no creadit card required

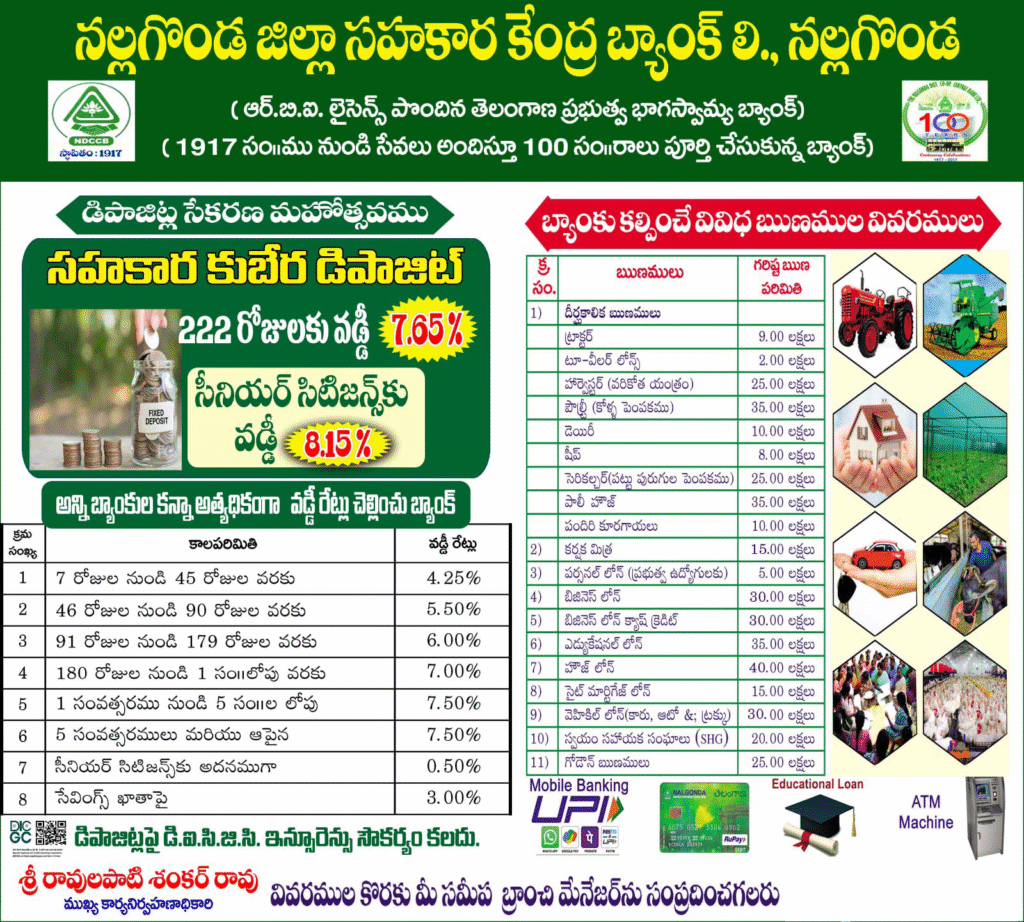

The Bank offers attractive rates on Deposits for various maturity periods. Facility for drawing interest on a monthly or quarterly basis is also provided.

Address : H. NO. 6-2-4, GD. & 1ST. FLOOR HYDERABAD ROAD, NEAR CLOCK TOWN, H. P. O. NALGONDA – 508 001

Email : ceo_nlg@nlgdccb.org

Phone : 9912344259 / 08682 295621

Copyright © 2025 NalgondaDCCB . Powered by Smartify Software Solutions